Vietnam overtakes China as largest exporter to U.S.

According to Furniture Today research, Vietnam shipped just over $7.4 billion in furniture to the U.S. in calendar year 2020, up 31% from the $5.7 billion it shipped in 2019. By comparison, China shipped $7.33 billion to the U.S in the same 12-month period. That number was down 25% from the $9.7 billion China shipped in 2019.

While the gap is relatively small, Vietnam’s position on the world stage shows how it has grown in importance over the years.

This, of course, started slowly with Vietnam emerging as a force in wood bedroom in response to Chinese bedroom manufacturers being hit with antidumping duties starting in June 2004.

An even more dramatic shift has occurred over the past two and a half years as the U.S. government imposed tariffs as high as 25% on almost all furniture categories. Even mattresses migrated to other countries outside China once duties were assigned to that category.

In the second half of 2018, for example, when China tariffs started at 10%, the industry had already begun to move out of China, although slowly at first. China furniture shipments fell 1% to $13.6 billion. Vietnam’s shipments meanwhile grew by 9% to $4.2 billion from $3.9 billion in 2017.

A more dramatic shift occurred in 2019, when China shipments fell 28% to $9.7 billion. Vietnam’s shipments meanwhile rose 35% to around $5.7 billion.

Vietnam moves ahead

Thus, two consecutive years of double-digit increases and decreases for each country has finally pushed Vietnam ahead of China.

“That doesn’t surprise me at all,” said Fred Henjes, CEO of Riverside Furniture Corp. “We are no longer buying product out of China, and I know there are many others besides us.”

He noted that bedroom, dining room, occasional and home office furniture are all strong categories for Riverside out of Vietnam. While order backlogs remain high, particularly due to logistics challenges such as securing containers, he said, shipments have improved of late.

“I’ve got to believe they are in it for the long haul,” Henjes said of Vietnam’s relevance in furniture manufacturing.

Others too say that Vietnam has become more important as a resource.

“It does not surprise me,” added Terry McNew, president and CEO of Klaussner Home Furnishings. “I think the increased tariffs on China have certainly impacted their price point.”

Klaussner, like many others in the wood segment, sources all of its wood furniture from Vietnam. McNew said that sales in the wood segment from Vietnam were up 10% last year.

Miscellaneous wood furniture was the largest category out of Vietnam with $1.9 billion in shipments, up 43% from the year before.

But the largest increase in terms of major product categories was in wood frame upholstered seating. It rose 83%, to $1.25 billion from the year before.

The next largest categories in order from Vietnam were wood bedroom furniture, where shipments fell 5% to $1.1 billion; wood frame upholstered chairs, which rose 22% to nearly $912 million and wood beds, which rose 11% to $778.9 million.

Shipments to U.S. dip

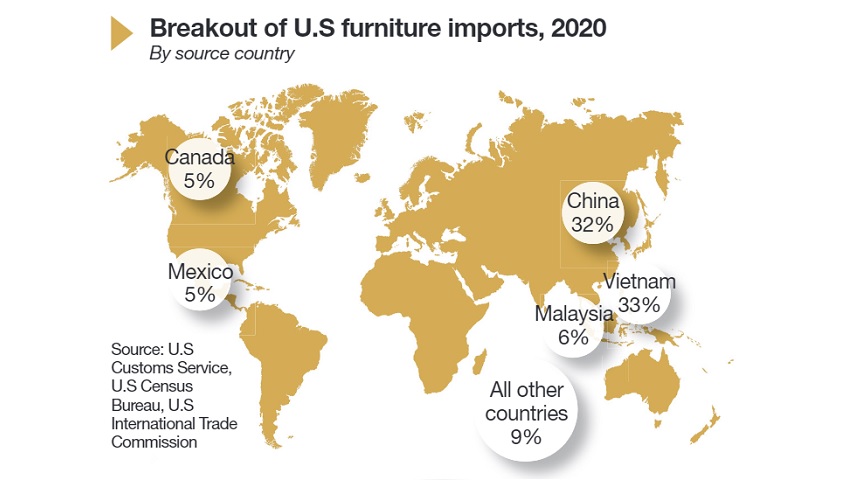

Overall, 2020 furniture shipments to the U.S. from overseas factories fell 1% to $22.7 billion, from about $23 billion in 2019.

Malaysia jumped two spots on the list of the top 10 exporting countries, moving ahead of Canada and Mexico for the number three slot. Shipments from Malaysia rose 47% to $1.4 billion, from $942.6 million in 2019.

Mexico’s shipments rose just 1% to $1.2 billion, while Canada’s shipments fell 15%, to $1.1 billion, moving it from the number three spot in 2019 down to number five.

Shipments from Indonesia rose 14%, to $855.3 million, while shipments from Italy fell 7% to $780.2 million.

Shipments from India fell 8% to $347.6 million and shipments from Thailand doubled to nearly $296 million.

Poland’s shipments fell 6% to nearly $249 million placing it at number 10 on the list, down from the number nine spot last year. Thailand’s impressive growth moved it into the list of top 10 countries at No. 9 on the list, moving ahead of both Poland and Taiwan, which held the No. 9 and 10 spots last year respectively.

At Hooker Furnishings division Home Meridian International, whose brands include SLF, Pulaski and Prime Resources International, product comes from various countries in Asia including China and Malaysia.

But the vast majority of SLF and Pulaski’s wood lines come from Vietnam, while PRI sources almost all of its motion line from Vietnam as well.

While HMI, and many others, had challenges last year shipping goods of out Asia due to pandemic related disruptions, division president Lee Boone acknowledged the importance of Vietnam.

“It was all driven by the antidumping duties years ago and the (China) tariffs today. That ran a lot of furniture out of China,” Boone said. “And Vietnam is still trying to catch up and create capacity. They are not there yet with upholstery, but they have come a long way.

“It’s safe to say that most of the increases resulted from the exodus from China,” Boone added. “If the tariffs hadn’t happened, there wouldn’t be a demand for it. Because of the tariff, there is demand and these other countries are able to be competitive.”

Indeed, Vietnam’s gains in upholstery certainly have arisen from major resources such as Ashley, Manwah, Kuka, Kaiser and Happy Leather, all of which have an established manufacturing presence in the segment.

“All of that product that went from China to Vietnam, there is your increase,” said Kelly Hahn, chief creative officer of case goods resource DesignWorks Furniture. “Those upholstery factories jumped up so fast.”

Hahn also noted that with the demand from consumers stuck at home, wanting to buy new furniture, the numbers out of Vietnam could have even been higher were it not for shipping constraints that have plagued the entire industry.

“If everybody could have shipped what they needed, it could been a lot bigger,” he said.

Recommend

THE NOTIFICATION OF HAWAEXPO 2024

5th Apr 2023

Vietnam Furniture Industry & HawaExpo

8th Mar 2023

FACTORY VISIT

31st Jan 2023

Recent Article

THE NOTIFICATION OF HAWAEXPO 2024

5th Apr 2023

Vietnam Furniture Industry & HawaExpo

8th Mar 2023

FACTORY VISIT

31st Jan 2023

Get in touch with exhibitors

Get in touch with exhibitors Discover all the specs on their products

Discover all the specs on their products Save your favorites

Save your favorites Join the dynamic events

Join the dynamic events